Out of an Abundance of Caution

By Paul Hoffmeister, Chief Economist

· Our general view from early July remains the same: “Until we see a more clarified economic outlook, risk management should be a growing priority in coming months. Arguably, this is the kind of environment where one should seek to secure and protect investment gains.”

· It appears to be decades since this market has seen so many different, major macrovariables in play at the same time; each of which could impact asset prices dramatically.

· As we see it: the global economy is slowing significantly, especially in the manufacturing sector; Brexit is likely to occur this year, deal or no deal (otherwise Boris Johnson risks the same political fate as Theresa May); US-China trade negotiations are unlikely to produce a comprehensive agreement anytime soon; and civil unrest in Hong Kong could spark a severe crackdown from Beijing.

· The scariest chart today is possibly the US Treasury curve. If Fed rate cuts were going to more than offset today’s market risks, then why isn’t the Treasury curve steepening? Why is the curve inverting even more since the last FOMC meeting? The Treasury market appears to be signaling dark undercurrents to this market.

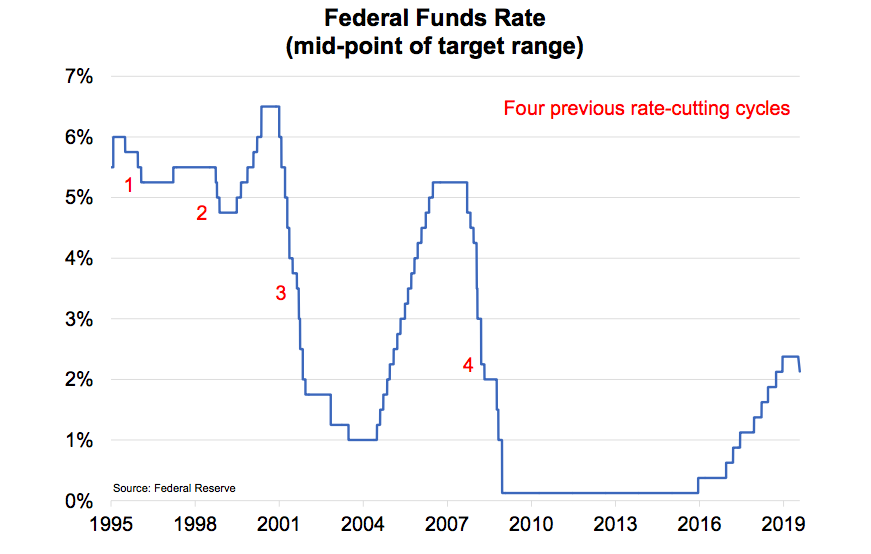

On Wednesday, July 31st the FOMC cut its target range for the federal funds rate by a quarter point to 2.00-2.25% -- the first rate reduction since 2008. In the post meeting press conference, Chairman Powell said that he didn’t view this as “the beginning of a long series of rate cuts”.[i] He added, “You would do that if you saw real economic weakness… That’s not what we’re seeing.” As such, Powell framed the rate cut as a “mid-cycle adjustment.” Clearly, equity markets were disappointed with the decision, as the S&P 500 fell 1.1% for the day.[ii]

The next day, many US equity indices were up significantly but quickly sold off following a tweet by President Trump announcing additional sanctions on Chinese imports, which will begin in September. Later in the day, Trump said about Chinese leaders, “If they don’t want to trade with us anymore, that would be fine with me.”[iii]

The abrupt equity weakness in recent days brings to an end weeks of seemingly boring, upward drifting equity markets. Such is the market these days. It’s difficult to be wildly bullish (many things could easily pop up and catch you wrong-footed), and difficult to be severely bearish (the Fed-induced rally this year has made that clear).

Ironically, though, when one looks at the performance (not including dividends) of theS&P 500 during the months following the initial rate cuts of the four previous rate-cutting cycles (which began in July 1995, September 1998, January 2001 and September 2007), the Index rallied 20% to 25% during the 12 months after the start of the 1995 and 1998 rate-cutting cycles, and sold off 10% to 15% after the start of the 2001 and 2007 cycles. Arguably, if history is any guide, one could easily get taken to the cleaners if they aggressively play this market incorrectly here.

So how does one position themselves? I would recommend caution.

Contrary to Jerome Powell’s perspective, the global economy appears to be meaningfully slowing. According to Markit Manufacturing PMI data, 27 out of 28 countries had manufacturing PMI’s of greater than 50 in January 2018 – meaning the manufacturing sectors were growing in nearly all the countries that Markit monitors. In January 2019, 18 out of 28 countries showed manufacturing growth (PMI’s greater than 50). Unfortunately, as of June 2019, just 11 countries were showing manufacturing growth. The global slowdown is increasingly real.

Even in the United States, which has enjoyed major corporate tax cuts and deregulation, the Markit manufacturing PMI for July registered 50.4, indicating that domestic manufacturing is on the verge of contraction. This is down from a high of 56.5 in April 2018.

Most worrisome to us, though, is Germany’s Markit/BME manufacturing PMI, which registered 43.2 in July. This is down sharply from 63.3 in December 2017. As we assess the economic data globally, the slowdown may be sharpest in Europe.

Arguably, it has been decades since this market has seen so many different, major macrovariables in play at the same time; each of which could impact asset prices dramatically.

For example: the global economy is slowing (what will be the impact to levered industries highly exposed to growth, such as banks?); the UK’s new Prime Minister Boris Johnson is promising Brexit by October 31st, deal or no deal (we believe him and expect tough talk, otherwise Nigel Farage’s new, highly successful Brexit Party will look to gain even more political ground); US-China trade appears to be more about global geopolitical competition and supremacy rather than a mere trade disagreement (can China realistically make wholesale changes to its economic model, quickly and without serious unintended consequences?); and civil unrest in Hong Kong doesn’t seem to be dying down (will Beijing send in PLA troops to quell the demonstrations?).

Even more, after having reportedly ruled out forex intervention to weaken the dollar, President Trump told reporters recently that he hadn’t ruled anything out.[iv] Uncertainty and volatility in the world’s reserve currency could have grave, far-reaching consequences. So far, we interpret the leak about dollar intervention and devaluation as a negotiating tool in the US-China trade talks. But it raises another substantial risk to the market today.

Clearly to an optimist or equity market bull, these risks and uncertainties could be tinder to ignite another major rally. If these risks fade or get resolved, equities could arguably climb much higher.

And importantly, not all is bad. At least the Federal Reserve is no longer purposely looking to slow economic growth with higher interest rates. And one notable uncertainty was clarified during the last month: impeachment risk. As we’ve suggested to clients, it appears that the Clinton impeachment hearings and related events in 1998 negatively impacted credit markets. Consequently, we believed it was possible that the pursuit of a Trump impeachment could have a similar, negative effect today.

Interestingly, on July 24th, the day of Special Counsel Mueller’s testimony before Congress, the spread between Moody’s Baa and Aaa-rated corporate bonds narrowed 9 basis points from 100 to 91 – an usually large one day move. It appears the Mueller testimony has stalled the push for impeachment. As former counsel to the Senate Judiciary Committee, Gregg Nunziata, told Wall Street Journal editor Paul Gigot recently: “…pro-impeachment Democrats hoped that this hearing would kind of fan the flames of impeachment and create a national demand for impeachment over the summer. And it’s clear that far from fanning the flames, this is a wet blanket… So I think impeachment has become less likely, and I think we’re more likely to have Donald Trump face the voters in November [2020]. And the voters will render their judgment...”[v]

Notwithstanding, the multitude of market risks or uncertainties appear to be creating dark undercurrents. The scariest chart today is possibly the US Treasury curve, which inverted even more during the days following the July 31st rate cut announcement and August 1st tariff news.

According to the St. Louis Federal Reserve, the spread between 10-year and 3-month Treasuries was -2 basis points on Tuesday July 30, 2019. As of Friday, August 2, the spread trades around -19.

If Fed rate cuts were going to more than offset today’s market risks, then why isn’t the Treasury curve steepening? Why is the curve inverting even more?

As we see it, the current market environment warrants an abundance of caution. Brexit looms, US-China trade negotiations are devolving, global growth is slowing significantly. And perhaps the current Fed policy approach isn’t enough. Most likely, the Fed will align with the market, and the recent rate cut will no longer look like a “mid-cycle policy adjustment”. As such, we are likely to see more disappointing economic data and more volatility in risk asset prices.

*******

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified. A899

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

[i] “Fed Cuts Rates by a Quarter Point in Precautionary Move”, by Nick Timiraos, July 31, 2019, Wall Street Journal.

[ii] Ibid.

[iii] “Trump Says It’s “Fine with Me” If China Doesn’t Want to Trade With the U.S.”, August 1, 2019, CBS News.

[iv] “Trump Suggests He Could Take Steps to Weaken U.S. Dollar, Fueling Confusion”, by Damian Paletta, July 26, 2019, Washington Post.

[v] Interview, “Wall Street Journal Editorial Report”, July 28, 2019, Wall Street Journal.