The Covid-19 Economy

Understanding the Recent Behavior in Stock & Political Markets

by Paul Hoffmeister - Chief Economist, Camelot Portfolios

Covid-19 Shutdown Has Been Economically Devastating

According to the U.S. Department of Labor, more than 30 million Americans have filed for unemployment benefits since mid-March 2020.

The national unemployment rate may now be 15%, up from 3.5% at the end of 2019.

GDP may contract by 20-30%.

Key Uncertainties:

how quickly will the pandemic fade?

what will be the scope and speed of an economic rebound?

Stocks May Have Found a Bottom

Covid-19 acceleration, economic shutdowns, and oil price war conspired to pull prices down in late February, early March.

Improving case numbers, news of economies reopening, and oil production deal helped to start pushing prices higher in late March, early April.

Most likely, stock indices will be primarily driven by Covid-19 outlook and economies restarting.

We must focus on any hints of a ‘second wave’.

Covid-19 Data Has Improved

According to Johns Hopkins, the most confirmed Covid-19 cases were in the United States, Spain and Italy.

According to the University of Washington, Covid-19 deaths in Italy peaked on March 27.

Covid-19 case trajectory in Italy seems consistent with recent stock market price action.

In late April, some Italian businesses started to reopen

According to the University of Washington, Covid-19 deaths in Spain peaked on April 1.

Covid-19 case trajectory in Spain appears consistent with recent stock market price action.

Many Spanish businesses plan on reopening in coming days.

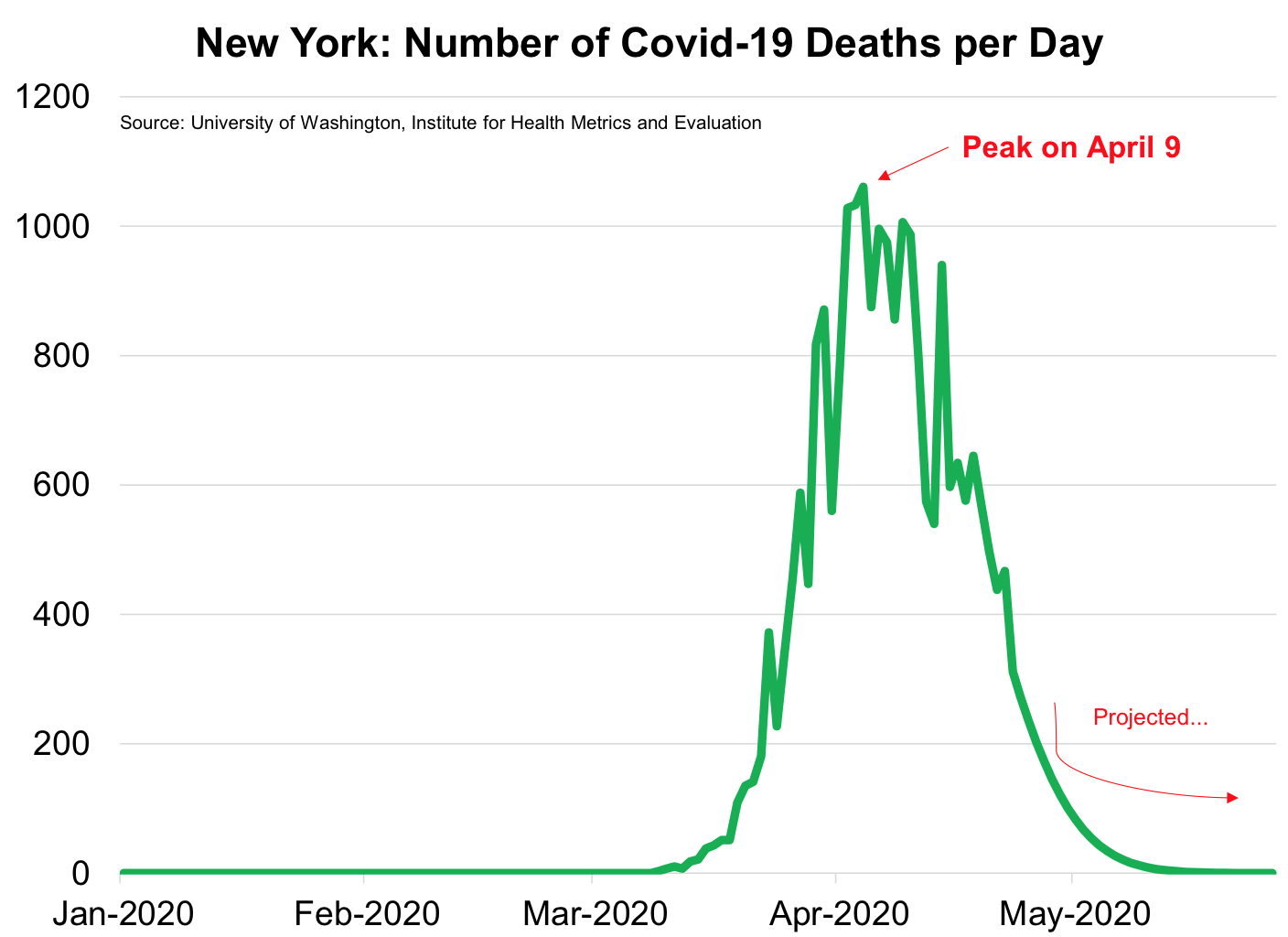

According to the University of Washington, Covid-19 deaths in New York peaked on April 9.

Covid-19 case trajectory in New York appears consistent with recent stock market price action.

New York “Pause Order”, effectively keeping non-essential businesses closed, is scheduled to be lifted on May 15.

Credit Conditions Are Stressed Today

One major macro risk in the current environment would be a disruption in credit markets, where a cascade of corporate defaults led to a weaker banking sector and reduced lending.

Credit markets appear to be highly correlated with oil prices; where weak oil prices lead to greater credit market stress.

Prolonged and excessively low oil prices may create systemic economic risk.

Trump’s Reelection Odds Rebounded w/ Stocks

President Trump’s reelection odds (based on betting markets) seem to be tied with the stock market.

Currently, the Predictit betting market is implying a roughly 50% chance of the President winning the November election; up from a recent low of 45% on March 19.

This suggests that President Trump’s political fate rests heavily on the evolution of Covid-19 and the reopening of the economy.

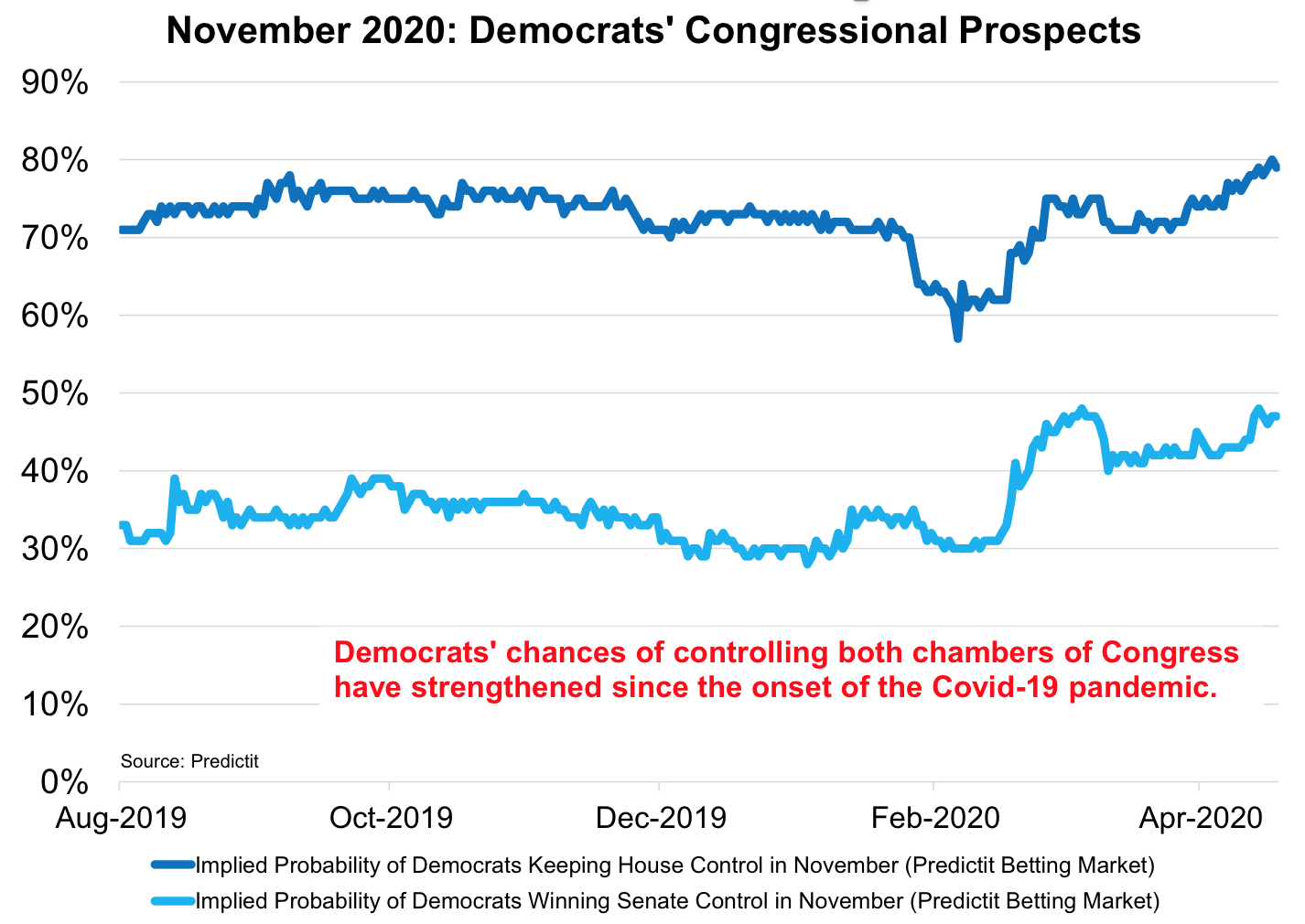

Democrats’ Congressional Prospects Are Strong

Despite President Trump’s recent rebound in betting markets, Democrats’ prospects for maintaining control of the House and retaking control of the Senate have improved.

Currently, betting markets are suggesting that the most likely political scenario in January 2021 is a Trump White House and Democratically-controlled Congress.

Conclusion

The pandemic’s impact on the US economy has been severe and unprecedented. Since mid-March, nearly 1 out of 10 Americans have filed for unemployment, and economic growth may have contracted by 20-30%.

Last month, we stated: “…the economy and financial markets will either improve or devolve during the next few weeks and months based on the spread of Covid-19, the availability of therapeutic and preventative remedies, and the reopening of the economy. Quite simply, financial markets need the spread of the virus to slow, viral treatments to show clear and conclusive efficacy, and economies to reopen.”

We believe the behavior of the S&P 500 in March and April confirms that view; as the growth in Covid-19 and global economic shutdowns appeared to correlate with the steep decline in stock prices, while the peaking of the virus in many regions (Italy, Spain and New York) and news of re-openings appeared to correlate with a rebound in prices.

Based on the recent behavior of betting markets, President Trump’s prospects for reelection are tied with the stock market, and thus implicitly, the trajectory of Covid-19 and the economy. While the prospects for Democrats to retake the White House haven’t improved during the last month, the prospect of Democrats gaining control of both chambers of Congress has improved. At the moment, betting markets are suggesting a divided government is most likely in 2021, with a Trump White House and Democratic majorities in the House and Senate.

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Disclosures

•Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

•This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

•Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

•Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.