by Paul Hoffmeister, Chief Economist

Since February 1, the S&P 500 is down over 4%, gold up more than 9%, and oil up over 20%, according to Bloomberg.

Ukrainian President Zelensky is demanding that NATO impose a no-fly zone over his country, warning that “all the people who die from this day forward will die because of you”. On Saturday, March 5, Vladimir Putin warned the West, “Any movement in this direction will be considered by us as participation in an armed conflict by that country.”

The potential exists of a systemic shock to the global economy if financial intermediation becomes paralyzed due to the economic and financial consequences of the conflict.

After weeks of tension, Vladimir Putin invaded Ukraine on February 24, and in addition to the human toll, the financial consequences have been stark. According to Bloomberg, since February 1, the S&P 500 is down over 4%, gold up more than 9%, and oil up over 20%.

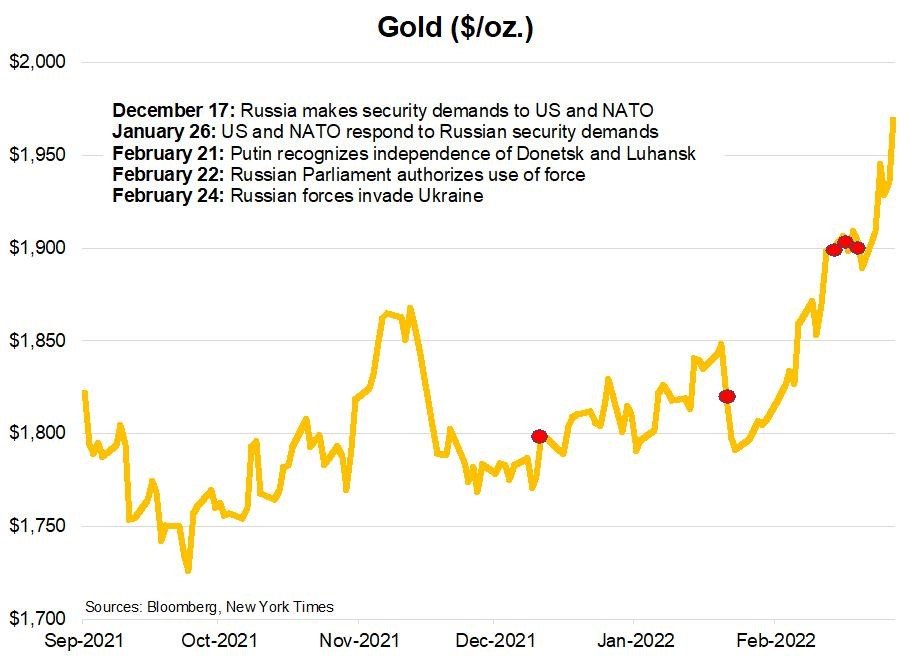

As gold is arguably a useful reflector of geopoltical developments, the above gold chart illustrates the correlation between the evolution of recent Ukraine events and ultimately market prices, such as gold.

On December 17, Russia published draft security pacts for the US and NATO. Included in its demands to the West were denying NATO memberships to Ukraine and other post-Soviet countries, rolling back troops and weapons in central and eastern Europe, and other limits on Western military activities near Russia. The US and NATO responded in writing on January 26.[i] In a brief moment of hope, Secretary of State Blinken called the response a “serious diplomatic path” to resolving the dispute. But, shortly thereafter, Russian Foreign Minister Lavrov said that he saw “no positive reaction” to Russia’s demands, which echoed Kremlin spokesman Dmitry Peskov, who said that the West’s responses were “not much cause for optimism”.

After weeks of growing tensions and a Russian buildup of troops along the Ukrainian border, President Putin issued a presidential decree on February 21 recognizing the independence of the Luhansk and Donetsk republics, which have deep ties to Russia and where the majority of the populations’ first language is Russian.”[ii] The next day, Russia’s parliament, the Duma, authorized the use of force in Ukraine. Two days later, on February 24, the invasion of Ukraine began.

Thus far, the military assault is focused in the eastern Ukrainian provinces and near Kiev, and the United Nations reports that nearly 1.5 million Ukrainians have been displaced. In the coming days, Russia and Ukraine will continue talks, but not many are optimistic.

President Zelensky is demanding that NATO impose a no-fly zone over his country, warning that “all the people who die from this day forward will die because of you”.[iii] On Saturday, March 5, President Putin warned the West, “Any movement in this direction will be considered by us as participation in an armed conflict by that country.”

The geopolitical risks today cannot be understated, and could quickly push the United States and Russia into a standoff not seen since the Cuban Missile Crisis. For investors, the important variables to monitor in the coming days and weeks is the extent to which the West will “participate” in fighting in Ukraine, and the risk of a direct conflagration between US/NATO and Russian troops.

In addition to the risk of an expanded fight – particularly between the West and Russia -- there is a major risk to global financial conditions. It’s possible that the economic toll and sanctions could have a knock-on effect on the banking system and the flow of credit.

For example, the Biden Administration and the European Union issued its first round of sanctions on February 22, which were aimed at two Russian banks, Russian sovereign debt, and certain individuals.[iv] Then, by the weekend of February 26-27, the European Commission revealed that it was considering sanctions that it could target up to 70% of the Russian banking industry. On February 28, the ECB announced that the European subsidiary of Sberbank Europe AG and two subsidiaries were failing or likely to fail due to a deterioration in their liquidity situation.[v] The next day, European regulators announced that the Sberbank AG would enter insolvency proceedings.

This news of Sberbank’s European subsidiary failing correlated with the relatively sudden and significant widening in credit spreads, suggesting a sudden panic in global liquidity conditions. Specifically, the Moody’s Baa-Aaa credit spread widened from 73 basis points on February 22 to 91 basis points on February 28.

[i] “U.S. Responds to Russia Security Demands as Ukraine Tensions Mount”, by Humeyra Pamuk and Dmitry Antonov, January 26, 2022, Reuters.

[ii] “Putin Recognizes Independence of Ukraine Breakaway Regions”, February 21, 2022, Al Jazeera.

[iii] “Ukraine no-fly zone would mean participation in conflict: Putin”, March 5, 2022, Al Jazeera.

[iv] U.S. and Allies Impose Sanctions on Russia as Biden Condemns ‘Invasion’ of Ukraine”, by Michael Shear, Richard Perez-Pena, Zolan Kanno-Youngs, and Anton Troianovski, February 22, 2022, New York Times.

[v] “Austria-based Russian Bank Declared Insolvent Due to Sanctions”, March 4, 2022, The Local.

DIAL IN FOR OUR MONTHLY

EVENT-DRIVEN CALL

Every 3rd Wednesday at 2:00pm EST

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2021 Camelot Event-Driven Advisors, All rights reserved. B333