by Paul Hoffmeister, Chief Economist

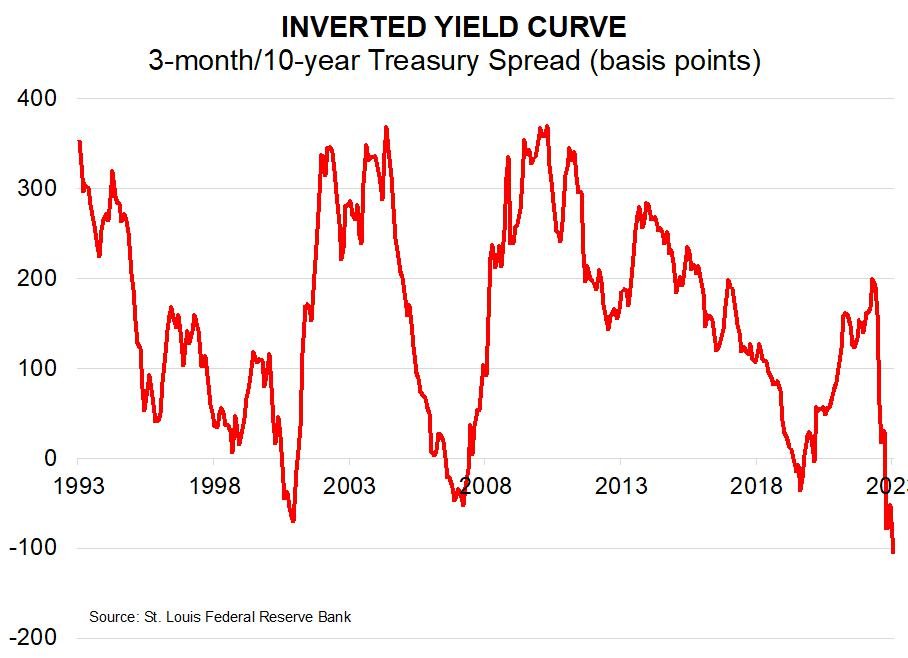

As clients might know from our previous letters and conference calls, we believe that the currently inverted yield curve effectively being spearheaded by the Fed’s aggressive rate-hiking campaign is signaling a high likelihood of recession during the next year. As of Friday, the 3-month/10-year Treasury spread traded at a negative 107 basis points. This is a historic degree of inversion, which we haven’t seen since the early 1980s, which has only increased our concern about the economy weakening significantly in the near future. The last three times that this segment of the curve inverted was in 2000, 2006 and 2019. Of course, each of those years preceded major ructions in the economy: the Tech Wreck, the Great Financial Crisis, and the Covid Pandemic. Notably, in each of those instances, the yield curve did not invert as much as it has today.

So, while we may feel confident in the view that the US economy will slow meaningfully in 2023, what does this mean for equities? After all, with many equity indices having fallen 20% to 30% last year, doesn’t that set us up for stronger equity returns in 2023? We’re not so optimistic.

According to Bloomberg, analysts are generally expecting the S&P 500 Index to earn about $225 per share in 2023. If one applies a 20 multiple to those earnings (we’d argue that a lower multiple is more appropriate), that would equate to a 4500 year-end price target in the S&P 500. With the Index starting the year at 3839.50, that would be an attractive +17.2% return this year, not including dividends.

Unfortunately for the outlook, when one looks at the three previous periods of yield curve inversions (2000, 2006 and 2019), S&P 500 earnings declined substantially, by at least 30%. That would equate to $157.50 per share and, at a generous 20 multiple, a 3150 target for the S&P 500 or -18% return (not including dividends).

If one assumed that the economy will only suffer a shallow recession and earnings slowdown this year and therefore assumed, let’s say, a 10%-15% decline in earnings to $191.25-$202.5, this would equate to a 3825 to 4050 S&P 500 by year-end at a 20 multiple; in other words, about a -0.40% to +5.5% return for 2023 (not including dividends).

Adding to our lack of enthusiasm for equity returns this year and bolstering our view that earnings will decline are clues that the US economy is already weakening, in a way reminiscent of the economic malaises of the last 20 years.

Specifically, the Institute for Supply Management’s Manufacturing PMI registered below 50 in November and December, indicating that the manufacturing sector is already shrinking. But even more notable, the ISM Services PMI registered a sub-50 reading for December. This services reading tends to shrink less frequently than manufacturing and appears to be a better predictor of a broader economic weakness. For example, each of the last times this index fell below 50 to signal a shrinkage in the services sector, the recessions associated with the Tech Wreck, Great Financial Crisis, and Covid Pandemic followed.

Amidst all this, unfortunately, the Federal Reserve remains intent on raising short-term interest rates to slow the economy even more and is telegraphing to markets that once it’s done with its rate hikes, it plans to keep interest rates high for a prolonged period of time.

Indeed, news in the coming weeks or months that the Fed is done with its rate-hiking cycle could spark some relief and strength in equities. But this arguably won’t adequately reflect the delayed effects of high interest rates and anti-growth monetary policy that will likely weigh on the economy throughout the first half of 2023. As such, today’s extreme yield curve inversion and emergent signs of economic weakness lead us to believe that corporate earnings are highly vulnerable to a decline in the coming year. And as a result, the risk-reward for equities in general is unattractive.

DIAL IN FOR OUR MONTHLY

MARKET UPDATE CALL

Every 2nd Tuesday at 11:00am EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Portfolios LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B435

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Portfolios, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Portfolios, LLC’s disclosure document, ADV Firm Brochure is available at www.camelotportfolios.com

Copyright © 2023 Camelot Portfolios, All rights reserved.