Potential Fallout: US-China Trade, Brexit, and Who Wins in 2020

by Paul Hoffmeister, Chief Economist - Camelot Portfolios

For this month’s commentary, we are sharing a series of slides and charts -- along with brief comments -- to expand on many of our views about the current market environment.

As we see it, the 2017 stock market rally was catalyzed by the pro-growth momentum of tax cuts and deregulation. Unfortunately, it was interrupted in 2018 by worries that the Fed would seek to squash it with aggressive rate increases, for fear that too many people working would spark inflation. By December 2018, after the FOMC telegraphed the possibility of two quarter-point rate increases for 2019, stocks seemed to scream for the Fed to stop. Powell & Company arguably conceded to the market, with “patience” having been the standing policy approach since January. Did the rate increases of 2018 go too far? I believe so, especially as other major economies appear to be slowing, and investors and economic actors face the specter of increased US-China trade tensions and Brexit uncertainty.

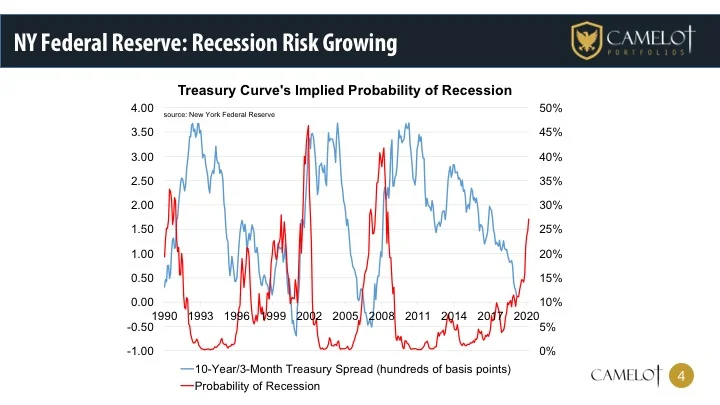

This chart shows the spread between the 10-year Treasury and 3-month T-Bill through Q1 2019. More recently, that spread inverted and traded near -25 basis points. Certainly, an inverted yield curve can be worrisome, and it’s possible that the US will flirt with a recession within the next 1-2 years. But such a scenario is not inevitable. The US and China could reach a trade agreement, Brexit uncertainties could be clarified, and risk-taking and production in slowing economies could rebound. We need some of the major macro variables to go right in the coming year… According to the CME Fed Watch tool, as of May 30, 2019, fed funds futures were calculating an 85% probability of a rate cut by this December’s FOMC meeting, a 15% probability of no rate cut and no chance of a rate increase. Recently, most Fed officials weren’t predicting a rate cut this year. Who’s going to be proven correct: Fed officials or financial markets?

Economic risks are rising. According to the New York Federal Reserve: Treasury curve flattening/inversion = increasing probability of US recession.

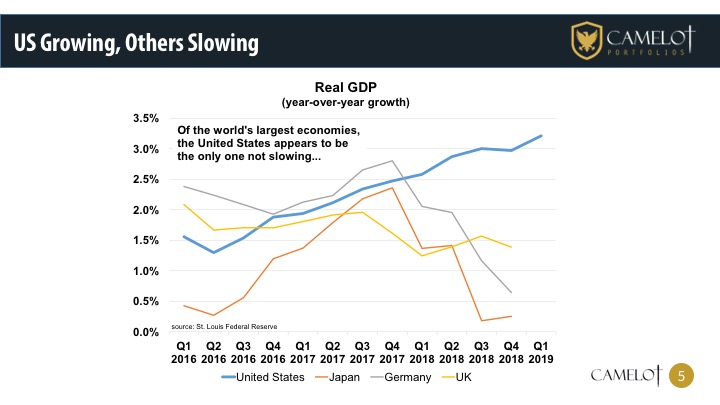

Analyzing the five major economies (US, China, Japan, Germany & the UK), the United States has had, in our view, the most pro-growth policy mix of the last 2.5 years: lower taxes + less regulation + fairly stable currency.

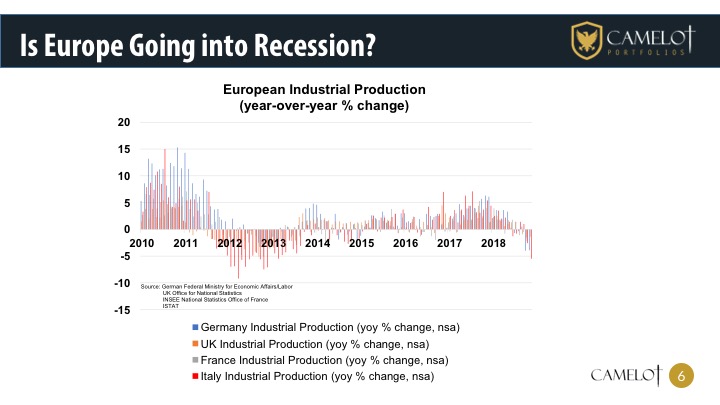

Europe’s economic outlook is deteriorating, at least from the perspective of industrial production. Where is the pro-growth policy response? It seems that the ECB monetary lever will only be used if the situation is dire enough. And major tax cut plans, in many cases, are being obstructed. For example, Italy’s deputy prime minister Matteo Salvini wants his coalition government to implement a 15% flat tax as part of an effort to reduce unemployment to 5% from 10%.[i] But he’s getting pushback from European Commission leaders, who want Italy to observe strict deficit targets.[ii] Very likely, we will soon see a major debate in Europe about whether lower unemployment and growth should be the economic policy objective rather than strict deficit targets.

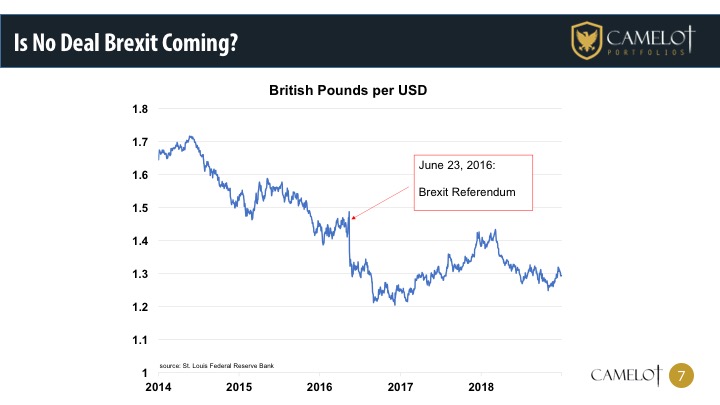

Prime Minister Theresa May wasn’t able to deliver on Brexit, and it seems the UK electorate has punished her Conservative and the Labour parties for it. The May 23rd EU Parliamentary Elections resulted in the Brexit Party winning with 31.6% of the vote – an incredible feat for a party only a few months old.[iii] Labour and Conservatives received 14.1% and 9.1%, respectively.[iv] With this kind of political momentum, the Brexit issue will almost certainly not go away… Note, the anti-Establishment, populist-nationalist sentiment in Europe is growing. Based on the recent parliamentary elections, populist, nationalist parties could control at least 150 seats in the new 751-seat European Parliament.[v] As Salvini put it last week, “the European people are asking for a different Europe.”[vi] The UK is scheduled to leave the European Union on October 31. Should that deadline not be met, Nigel Farage (founder of the UK’s Brexit Party) promises bigger gains in the next general election to sweep the UK’s dominant parties from office.[vii]

In recent years, the Shanghai Composite appears to be highly sensitive to the US-China trade outlook. This could validate President Trump’s view that the United States has the leverage in these negotiations.

Are poor stock market returns in China enough to persuade Chinese leaders to make massive changes to their country’s “business model”? If their economic model has worked so well for the last two decades in catapulting the Chinese economy to becoming the world’s #2, would it be better for China to simply accept the Trump tariffs as a cost of doing business?

According to a Bain and Co. survey, 60% of high-level executives at American multinational firms say they’re ready to adjust their business strategies due to the US-China trade dispute.[viii] And anecdotally, we are seeing some manufacturing already shift away from China. Will India, Thailand and Vietnam be the beneficiaries?

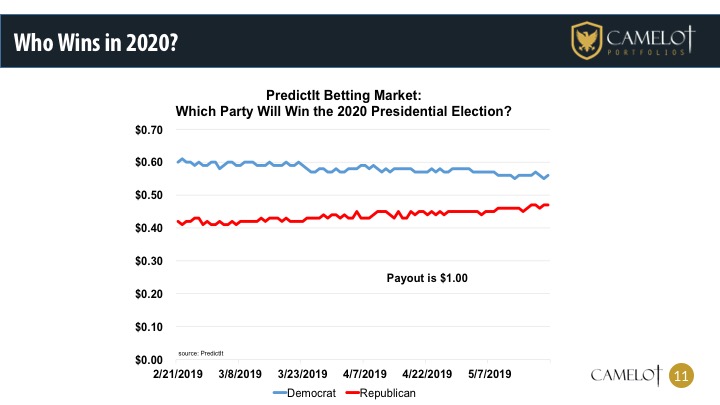

At the moment, the PredictIt betting market believes that Democrats have a better chance of winning the White House in 2020.

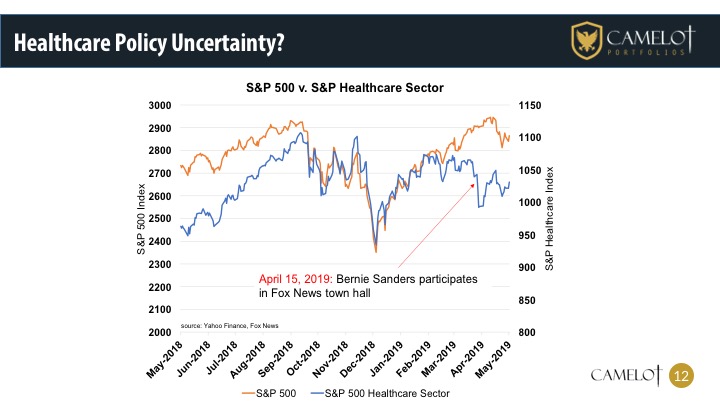

Healthcare may be the biggest election issue that could impact markets as we approach November 2020. For example, Bernie Sanders’ focus on “Medicare for All” during a Fox News town hall arguably pulled the healthcare sector lower in April.

Disclosures:

•Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

•This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Portfolios LLC can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

•Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

•The S&P 500 is an unmanaged index used as a general measure of market performance. You cannot invest directly in an index. Accordingly, performance results for investment indexes do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results

•Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified

A858

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

[i] “Brussels Set to Intervene over Italy’s ‘Fiscal Shock’ Plan”, by Mile Johnson and Mehreen Khan, May 28, 2019, Financial Times.

[ii] Ibid.

[iii] European Election Latest Results 2019: Across the UK”, by Sean Clarke, Pablo Gutierrez and Frank Hulley-Jones, May 26, 2019, by The Guardian.

[iv] Ibid.

[v] “The Latest: Salvini Says Populists Will Control 150 EU Seats”, May 26, 2019, AP News.

[vi] Ibid.

[vii] “Nigel Farage Issues Bold Promise on Action He Will Take If UK Doesn’t Leave on October 31”, by Darren Hunt, May 30, 2019, Express UK.

[viii] “Southeast Asia May Not Be the Next ‘Factory of the World’ Even as Production Moves Away from China”, by Huilen Tan, April 8, 2019, CNBC.