by Thomas Kirchner, CFA

From substitute for war to forcing domestic policy change.

Declining success rate of sanctions in the last 25 years.

Russia sanctions cost West more than Russia.

World needs a new Vienna Congress.

In 433 BC, Athens barred merchants from neighboring Megara from selling their wares in the Athens market. These earliest recorded sanctions didn't work out too well for the Athenians. The Megarians teamed up with the Spartans to wage the Peloponnesian War, which ended Athens' golden age [I]. The effectiveness of sanctions has not become much better since antiquity. Famously, sanctions on Iraq and Cuba helped Saddam Hussein and Fidel Castro cement their power by allocating scarce imports to their most loyal supporters.

We decided to take a closer look at the Global Sanctions Data Base (GSDB) that is maintained by a team of researchers and spans 1,101 sanctions measures over the period 1950-2019 [ii]. The database does not cover sanctions of the 1920s and 30s, when uncoordinated ad-hoc measures against the axis powers contributed to the collapse of world trade but failed to prevent World War II. After all, following the horrors of World War I, sanctions became the go-to tool for warfare in the 1920s, replacing military conflict through economic warfare. President Woodrow Wilson proclaimed in 1919: “A nation that is boycotted is a nation that is in sight of surrender.” [iii] That, at least, was the idea, which has since become religion. As we will discuss, wrongly so.

The most sanctioned regions will surprise you

The GSDB reveals that, not surprisingly, the countries of North America, Northwestern Europe and Oceania are the least frequently ones targeted by sanctions. Less obvious is that Africa and West Asia are targeted most frequently. Interestingly, most sanctions on African countries are imposed by other African countries. We wonder if much of Africa's regionalism is due to these sanctions. After all, if you want to fly from one African city to another, the only flights available often make you connect through London, Paris or Frankfurt.

Since 1950, the U.S. has been the most frequent sanctioning nation, imposing more than one third of all sanctions worldwide. Under President Obama, the share of all sanctions imposed by the U.S. declined to 30%, in particular after Iran sanctions were lifted in 2016, but rose in the subsequent four years under President Trump to 40%. Trump is said to have been the most active sanctioner of all time, averaging three new measures per day [iv].

From avoiding war to influencing domestic policies

The policy objectives of sanctions have evolved over the years. Sanctions evolved from a substitute for war, as in Wilson's days, to a tool to influence domestic policies in another country. Until 1960, war and territorial conflicts were the principal reasons for sanctions. From the 1970s, human right-related sanctions started to increase, which due to their sharp increase cumulatively represent the largest category since 1950. Democracy is the second-most frequent category. Ending wars is only the 4th most frequent objective for sanctions [iv]. We would assume that this drift toward domestic policy changes also makes sanctions less effective. After all, human rights violations or other objectionable domestic policies are often at the core of a regime's power base. Being sanctioned then is just one of the many costs of staying in power.

Effectiveness

Not surprisingly, the effectiveness of sanctions is hotly contested. Clearly, sanctions labeled “crippling” are imposed with a strong conviction that they will achieve their stated goals. Unfortunately, the data stand in sharp contrast to such overconfident boisterous announcement. Successes are rare. A notable exception are the 1995 sanctions against Peru and Ecuador after border skirmishes along a long-contested area near the Cenepa river had broken out. The sanctions were lifted after both sides consented to the deployment of international observers. However, since this is not a controlled experiment, we can not rule out the possibility that the same outcome would have been had without the imposition of sanctions. Attributing such successes to sanctions might overrate their effectiveness.

Until the mid-1960s, 50% of sanctions in the GSDB are classified as failures, only 20-30% are successes. The situation improved over the following 30 years: by 1995, 50% of all sanctions were considered a complete success. Unfortunately, in the quarter century since 1995, there is a sharp decrease in the success rate. As of 2016, only 20% of sanctions are deemed a complete success, roughly 70% are “ongoing”, which in many cases probably means that nobody wants to admit their failure, so the path of least resistance is to keep them going [iv]. Partly, the decreasing success rate is due to the sharp rise in anti-terrorism sanctions, which we would expect to be of little deterrence on the determination of terror fanatics.

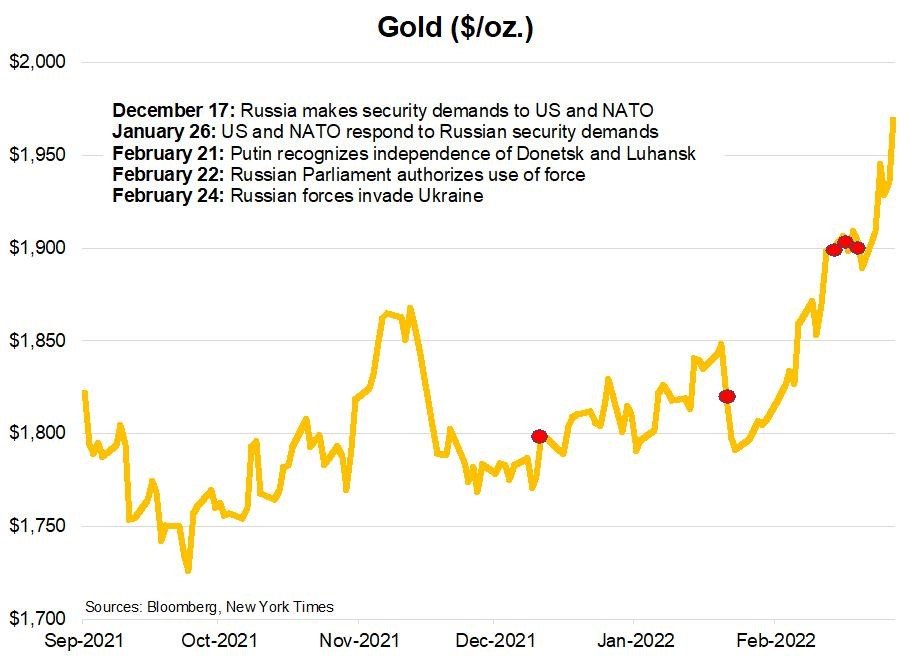

Sanctions against Russia over the Ukraine war

JP Morgan estimates the impact of sanctions on the Russian economy on 11% of GDP and reduced growth in the EU at 2.1% of GDP[v]. This estimate amounts to $165 billion in annual sanction losses for Russia and at least $357 billion for the EU alone, even more if you add non-EU Europe and North America [vi]. As long as JP Morgan's estimates are not completely wrong, the West will suffer more under its own sanctions than Russia. We estimate that only for a contraction of 30% or more will the harm to Russia be worse than for the West. Should gas deliveries to Western Europe be disrupted, then no crash of the Russian economy would be big enough to match the economic devastation of Western Europe.

We can think of other ways how the sanctions are likely to backfire. For example, the ban on exporting technology will only have a short-term impact. We would like to remind readers that the Soviet Union perfected the art of procuring Western technology at the time of the iron curtain. In fact, Soviet microprocessors were copies of Intel and Zilog chips, the export of which to the Warsaw Pact was illegal. We would expect this phenomenon to return as a result of the sanctions. Fake chips from China are already a major problem for the semiconductor industry. If China can manufacture fake chips on a large scale, there is no reason why Russia wouldn't be able to do the same. Such fake chips, which will be much cheaper than the genuine ones, will then find their way into the Western market, where they will only aggravate the scourge of fake chips.

While we certainly wish that sanctions on Russia would end this war quickly, we won't hold our breath. The deck is stacked against their effectiveness. What this conflict needs is a diplomatic solution: a new Vienna Congress.

[i] Camelot calculations based on Bloomberg data.

[ii] Gabriel Felbermayr, Aleksandra Kirilakha, Constantinos Syropoulos, Erdal Yalcin, Yoto V. Yotov: The Global Sanctions Data Base. LeBow College of Business, Drexel University, School of Economics Working Paper Series, WP 2020-02.

[iii] Maxim Trudolyubov: “Sanctions Should Impose Costs Where They Are Due” Wilson Center, September 20, 2020.

[iv] Gabriel Felbermayr, Aleksandra Kirilakha, Constantinos Syropoulos, Erdal Yalcin, Yoto V. Yotov: “The Global Sanctions Data Base: An Update that Includes the Years of the Trump Presidency” LeBow College of Business, Drexel University, School of Economics Working Paper Series, WP 2021-10.

[v] Randall W. Forsyth: “Putin’s War Puts Russia’s Economy—and the World’s—in Its Crosshairs.” Barron's, March 2, 2022.

[vi] Camelot calculations based on World Bank data.

DIAL IN FOR OUR MONTHLY

EVENT-DRIVEN CALL

Every 3rd Wednesday at 2:00pm EST

REGISTER FOR CALL

Thomas Kirchner, CFA, has been responsible for the day-to-day management of the Camelot Event Driven Fund (EVDIX, EVDAX) since its 2003 inception. Prior to joining Camelot he was the founder of Pennsylvania Avenue Advisers LLC and the portfolio manager of the Pennsylvania Avenue Event-Driven Fund. He is the author of 'Merger Arbitrage; How To Profit From Global Event Driven Arbitrage.' (Wiley Finance, 2nd ed 2016) and has earned the right to use the CFA designation.

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B340

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2021 Camelot Event-Driven Advisors, All rights reserved