by Paul Hoffmeister, Chief Economist

The most important macroeconomic variable today is the Fed.

The correlation this year between the Fed’s hawkish shift and weak equity markets is seemingly undeniable.

Equities will find support when the Fed stops pushing longer-term rate expectations higher.

Weaker economic activity and improved inflation data in coming months should stall the hawkish Fed momentum.

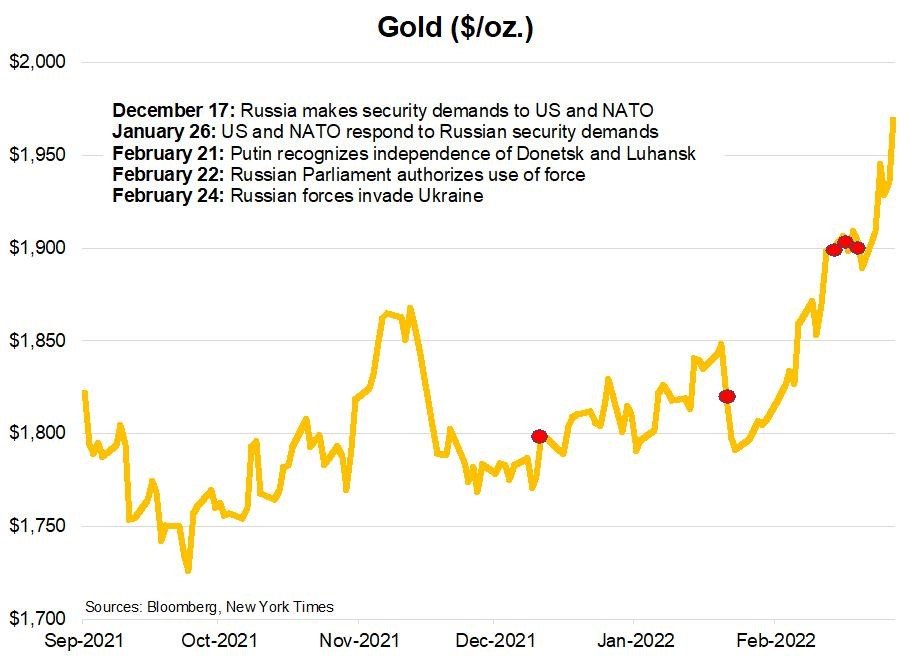

The macroeconomic circumstance of financial markets today appears to be fairly straight-forward. The U.S. economy has strongly recovered from the Covid pandemic, but inflation is now uncomfortably high and the Federal Reserve is focused on raising interest rates to slow growth to alleviate those inflationary pressures. In addition, the war in Ukraine has worsened inflation by exacerbating food and energy prices. Not to mention, it may have increased some risk for the financial sector due to concerns about Russian banks, the possibility of a Russian sovereign default, and general geopolitical uncertainty between the West and Russia.

But arguably, the most important macroeconomic variable in the world today is the Fed, and more specifically, its plan to raise interest rates. The major shift toward the hawkish Fed outlook that we have today began around the beginning of the year.

On January 5th, the Fed released the minutes of its FOMC meeting on December 14-15. The minutes stated that “it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.” During the weeks that followed, Fed officials began to telegraph a change in monetary policy, including a March rate increase. The January 26 FOMC statement ultimately confirmed that shift: “With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.” Since then, the hawkish Fed rhetoric has steadily increased as year-over-year CPI growth jumped to 8.5% and unemployment fell to 3.6%.

As a result, the 10-year Treasury yield has been on a tear higher this year, jumping from 1.51% on December 31st to more than 3.10% as of Friday.

The correlation between the Fed’s hawkish shift and weak equity markets is seemingly undeniable. As the chart below shows, the breakout in long-term interest rates in recent months has correlated with the selloff in the S&P 500.

Of course, financial markets aren’t driven by only one variable. For example, the invasion of Ukraine in late February was another factor that temporarily impacted stocks and bonds. But the general correlation between stocks and monetary policy this year underscores for us, once again, just how impactful Fed policy can be for financial markets.

So, as investors, where do we go from here?

If the predominant market variable is Fed policy, the first question we need to answer is: will the Fed outlook materially change from where it stands today? If we try to understand markets with this simple framework, it would suggest that additional signals from the Fed of even higher-than-expected interest rates will translate into further equity market weakness; and vice versa.

Unfortunately, last Friday, former Fed Vice Chairman Richard Clarida suggested that the federal funds rate will need to rise to at least 3.50% to get inflation under control. Currently, based on fed funds futures, the market seems to be expecting almost a 3.25% funds rate by year-end 2023. Therefore, Clarida’s comments were new, hawkish comments that markets needed to digest and discount.

If Clarida’s comments are any indication, it appears that the Fed has some more hawkish “telegraphing” to go. And, it's difficult to forecast how much further it will go in the coming weeks and months.

But to look at things optimistically today, the Fed has shifted market expectations significantly already. At the beginning of the year, fed funds futures were expecting nearly a 1.25-1.50% funds rate by year-end 2023. The futures market now expects approximately 3.25%. As such, the market has priced in nearly 200 basis points of additional rate increases for the medium-term policy horizon.

It's likely as well that the inflation picture will improve soon.

The Fed’s intention is to slow growth to reduce inflationary pressures (however flawed its policy tool is). The recent rise in interest rates, and the general rise in input costs and living costs, are likely having a dampening effect on growth already, which should translate into limited inflation gains in the coming months.

Furthermore, the post-pandemic phenomenon where consumers increased spending on goods could start to wane, and the ratio between goods and services spending could normalize. What this means is, the boom in spending on refrigerators and other household items, for example, should decline as consumers start spending more on travel and other services. If this normalization in spending patterns occurs, it should alleviate goods demand and bottlenecks in the supply chain; both of which should reduce the pressure on inflation statistics.

In sum, we could start to see slightly slowing economic growth AND a peak in inflation data. It’s possible, for example, that the year-over-year growth in CPI will start to decline from its current 8.5% rate to 4-5% by year-end.

In this scenario, we could see the aggressively hawkish Fed rhetoric of the last four months start to calm. And in turn, holding all other variables constant, this could ultimately translate into equity markets finding support again. Hopefully, nothing else in the global economy breaks in the meanwhile.

DIAL IN FOR OUR MONTHLY

EVENT-DRIVEN CALL

Every 3rd Wednesday at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B372

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2022 Camelot Event-Driven Advisors, All rights reserved.