by Paul Hoffmeister, Chief Economist

The US unemployment rate was 3.7% in May, and other employment data indicate a very high number of job openings and jobs added last month.

But the strong labor market does not mean that the US will avoid recession. In fact, history suggests that a recession will begin soon.

The unemployment rate tends to reach a cyclical low point right before recession.

The Treasury curve and Leading Economic Indicators suggest a recession will begin during the next 12 months. Based on data going back more than 60 years, it will be unprecedented if this didn’t happen.

During the second half of 2023, we’re likely to see: unemployment rise, the economy contract, earnings revised lower, and equity markets challenged.

The labor market appears to be so hot that it’s bucking recession concerns. Last week, the Bureau of Labor Statistics released the Job Openings and Labor Turnover Survey (“JOLTS” Survey), showing the US economy had 10.1 million unfilled jobs for the month of April – 750,000 more openings than the 9.35 million that Wall Street expected. For context, the record high for job openings is over 12 million in March 2022; and in February 2020, just prior to the Covid pandemic, openings were just less than 8 million.

Also released last week was the Employment Report, showing the economy added 339,000 jobs in May. Year-to-date, the economy is adding over 300,000 new jobs per month. And even though the unemployment rate rose slightly to 3.7% from 3.4% in April, the low reading two months ago was a 54-year low.

Indeed, employment data like this reflects a strong labor market and resilient economy in the face of the fast and aggressive rate increases by the Federal Reserve, which have raised the federal funds rate from near zero to more than 5% since early 2022.

Is this something to take comfort in? As investors, does the strong labor market allow us to rest easy that the economy will be resilient and avoid recession during the next year? Frankly, we’d say no.

Despite the recent employment data, the economy is vulnerable to falling into a recession, and it could happen surprisingly soon. History has shown that the unemployment rate reaches a cyclical low point right the onset of recession. Moreover, a number of recessions in the past began when the unemployment rate hovered near 4%.

The above chart illustrates how strong labor markets don’t necessarily preclude recession. Furthermore, it shows how the unemployment rate is more of a backward-looking indicator than forward-looking indicator.

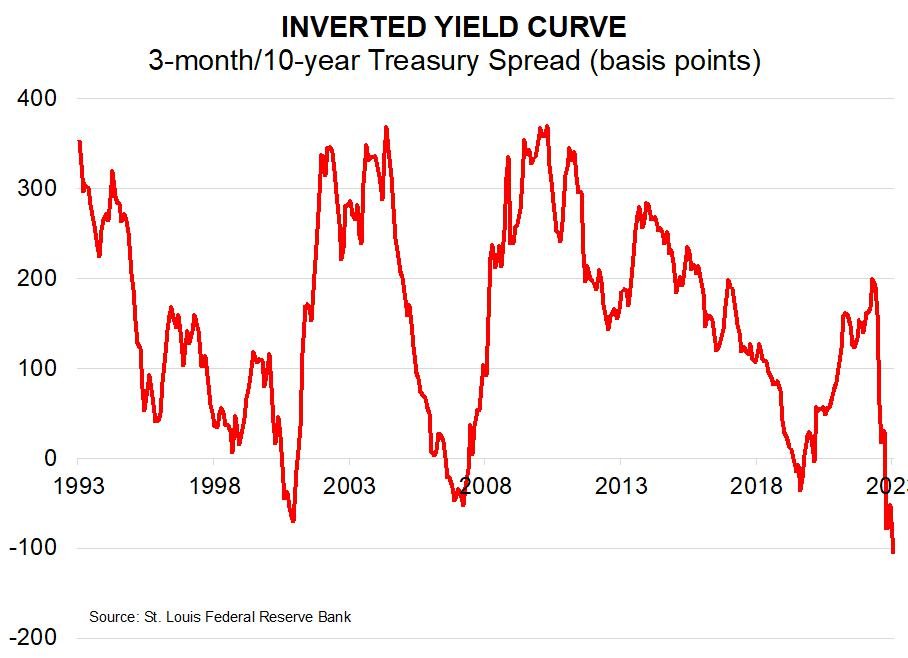

And as we’ve expressed many times, forward-looking indicators like leading economic indicators or the yield curve are signaling a high probability of recession soon.

For example, the Index of Leading Economic Indicators for the United States has been consistently weakening since February 2022, and to such a degree that ominously resembles major economic downturns of the last 60 years. According to the Conference Board: “…The LEI continues to warn of an economic contraction this year. [The Board] forecasts a contraction of economic activity starting in Q2 leading to a mild recession by mid-2023.”

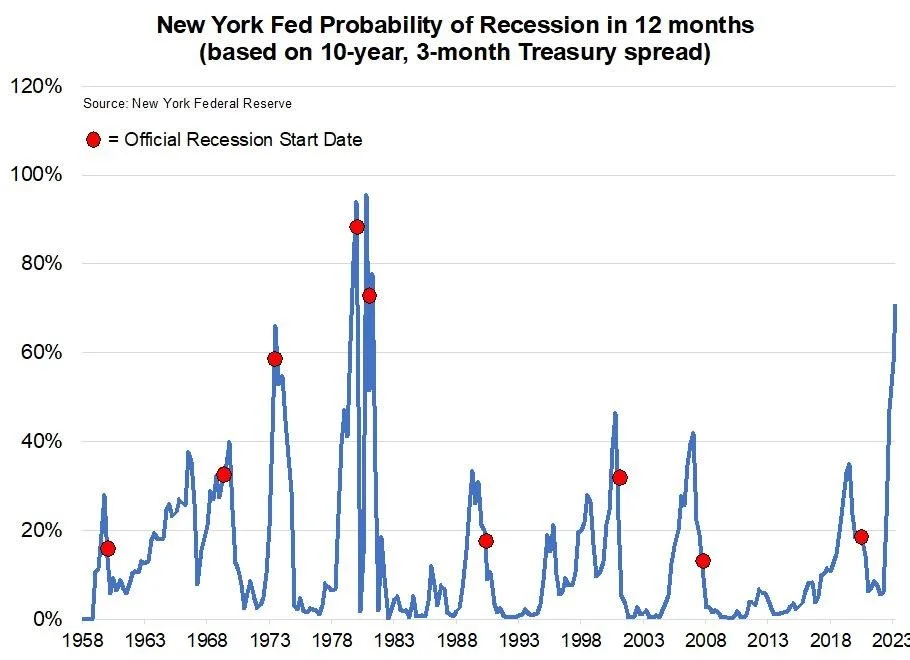

At the same time, the New York Federal Reserve estimates a 71% probability that a recession will begin during the next 12 months. This is based on the negative spread between the 10-year and 3-month Treasuries; otherwise known as the “inverted yield curve”.

Although the strong labor market is welcome news these days and it’s arguably helping to support earnings and equity prices, the strong employment data of recent months is a snapshot of the past. In fact, a low unemployment rate during the last six decades hasn’t prevented recessions, and low unemployment rates tend to precede the onset of recession.

Even more, forward-looking indicators are screaming that a recession will begin soon. This means that during the next year, we’re likely to see unemployment rise, the economy contract, earnings revised lower, and equity returns challenged.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B481

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2023 Camelot Event-Driven Advisors, All rights reserved.