by Paul Hoffmeister, Chief Economist

Interest rates will stay higher for longer. Following its April 30-May 1 meeting, the FOMC made clear that inflation has not sufficiently fallen toward its 2% target. Combined with the strong labor market and relatively resilient economic growth, the Committee maintained that it’ll maintain its current 5.25%-5.5% fed funds target, while signaling economic and inflation data will steer the path of interest rates. There’s even some chatter that the Fed might need to raise interest rates if inflation exceeds near-term forecasts.

In a barrage of Fed speeches since the decision, some officials have given life to that scenario. Governor Michelle Bowman stated, “While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed.” Minneapolis Fed President Neel Kashkari hinted at the possibility if inflation remained stubborn. Richmond Fed President Thomas Barkin stated that while the economy ended 2023 in a good place, “…early 2024 inflation data has been disappointing to those who thought that the inflation fight was behind us.”

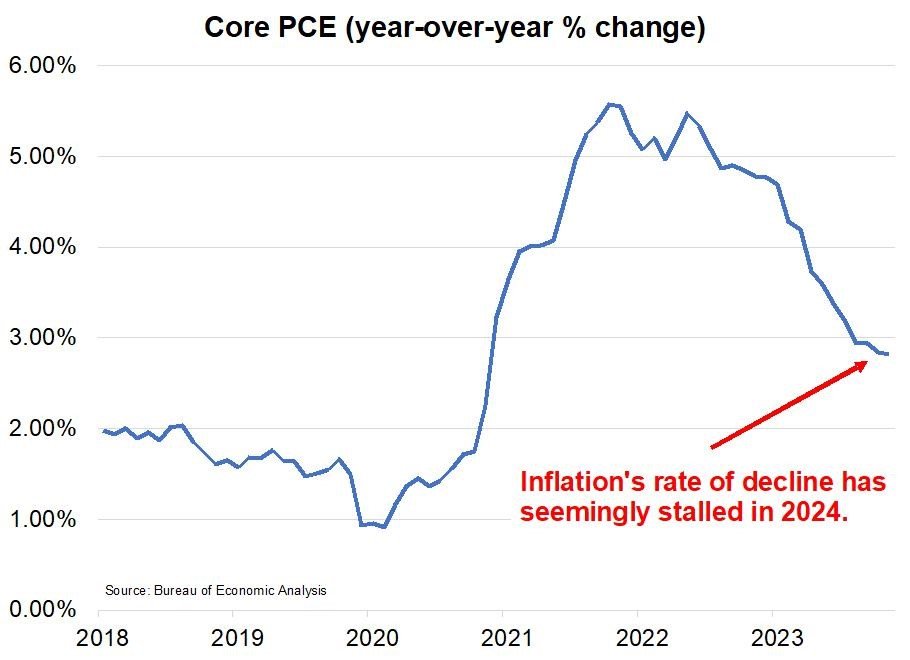

As a result, we’ve seen a major about-face in the Fed outlook since Chairman Powell surprised markets last December with his dovish pivot. Since then, the expectation by financial markets for where the funds rate will stand at the end of 2024 has jumped from 4%-4.25% to around 5%. The key development during the last five months has been the fact that the decline in inflation has slowed. In 2023, the core PCE inflation gauge fell from 4.9% to 2.9%; but this year, it’s stubbornly holding around 2.8%-2.9%. With the unemployment rate at 3.8%, stock indices near record highs, and credit spreads relatively tight, the Fed will remain focused on slowing economic growth further in order to also slow the current pace of price increases.

The Fed’s reaction function during the second half of this year will likely be predicated on where PCE and unemployment inflect. If core PCE broke below 2.8% and sufficiently trended to the low 2% range, then the Fed could finally pursue that dovish pivot. Another scenario for rate cuts might occur if unemployment broke above 4%; as a rate in the low 4% range would likely indicate the beginning of recession. Absent a meaningful decline in inflation or rise in unemployment, the Fed would likely need a major unraveling in financial market conditions -- such as a significant sell-off in stocks or widening in credit spreads -- to ignore stubborn inflation data and pursue rate cuts.

While the United States is treading water economically amidst the post-pandemic interest rate-hiking cycle, the most pronounced economic pain in the world is in China -- primarily in its real estate sector -- and now in Europe. Thus far, the UK, Ireland and Finland are in recession; France and Germany are seemingly teetering into contraction.

Not surprisingly in March, the Swiss National Bank was the first major, Western central bank to cut rates. And just last week, Sweden’s Riksbank followed with its own cut; and the Bank of England is signaling that it’s prepared to do so as well.

So, while the United States is seemingly holding up amidst today’s interest rate shock and the Fed is intent on keeping rates higher for longer, we’re seeing other central banks finally pivoting to relieve their respective economies from their multi-year chokehold.

Japan, the fourth largest economy in the world behind Germany, is also in recession today. Interestingly, the most acute effect of the Fed’s recent hawkish bias appears to be in the devaluation of the Japanese yen.

In early 2022, the yen traded near 115 per US dollar; today, it’s near 160. This major depreciation appears to be occurring in lockstep with Fed rate expectations. The weakness may indeed be caused by the “carry trade” where international traders are exchanging yen into dollars for a higher interest rate, not to mention increasing pressure on the weak Japanese economy from slowing growth externally (China and the United States are its two largest export markets). Given this currency-monetary policy relationship in recent years, it’s likely that Japan will continue to face its slow-rolling currency crisis as the Fed pursues its hawkish policy bias.

In sum, the effects of the global economy’s two-year interest rate shock is starting to show itself, with creeping recessions and emerging currency extremes. We’re seeing things “break” a little bit. Notwithstanding, US financial conditions are seemingly holding up so far, and with inflation refusing to slow down even more, the Fed is telegraphing that it’ll try to choke growth stateside a little longer to squeeze inflation further.

DIAL IN FOR OUR QUARTERLY

EVENT-DRIVEN CALL

3rd Wednesday of every quarter at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B571

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2024 Camelot Event-Driven Advisors, All rights reserved.