by Paul Hoffmeister, Chief Economist

Fed Governor Waller’s expectation that unemployment will increase to 4% or more suggests to us that a Fed-induced recession is inevitable.

Economic data do not warrant a change of course anytime soon by Fed officials.

We expect more economic and financial pain..

The most important macro variable of 2022 is arguably the Federal Reserve’s interest-rate hiking campaign. The federal funds rate target stands at 1.50-1.75% today, compared to nearly zero percent between March 2020 and March 2022. And there appear to be much higher rates to come. The fed funds futures market currently predicts that the most likely scenario is for the overnight rate to be somewhere around 3.50% by year-end. This means the FOMC has four more meetings to raise rates by nearly 200 basis points.

The pain in stock and bond markets is obvious this year. Equity indices such as the S&P 500 and Nasdaq Composite are down more than 15% and 25%, respectively; and the Bloomberg Aggregate U.S. Bond Index has fallen more than 10%. Optimists are hoping that the Fed will back away from its hawkishness sooner rather than later, and give relief to stocks and bonds.

Indeed, a Fed relief rally could be powerful. The most recent relief rally occurred during the first half of 2019 when the Fed backed away from the hawkish rhetoric that roiled markets at the end of 2018. The S&P 500 and Bloomberg Bond Index rallied nearly 20% and 9%, respectively, during the first six months of 2019.

If we go deeper into history to when the Fed was aggressively fighting inflation -- during the early 1980s under Chairman Volcker -- the end of that tightening campaign occurred in August 1982. The relief in markets led to a nearly 40% rally in the S&P 500 into the end of that year.

Without question, the hope that the Fed will soon back off is enticing for investors given the gains that were catalyzed when the Fed shifted policy course in the past. Unfortunately, it doesn’t appear that the Fed is close to shifting anytime soon.

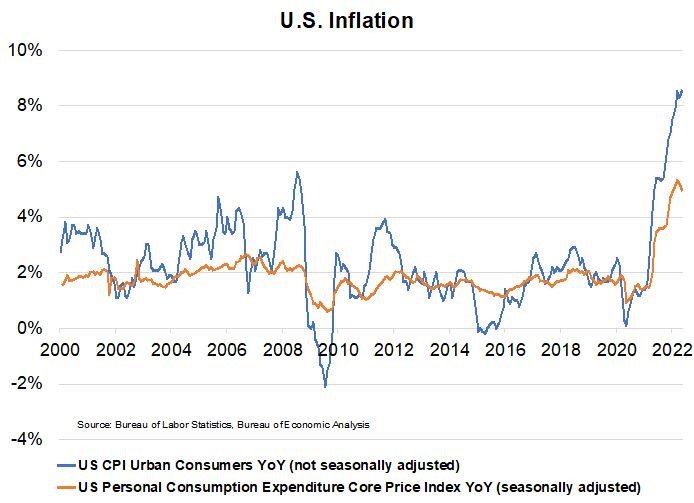

The CPI rose 8.6% year-over-year as of May, and is expected by many to register an 8.7% annual increase for June. That data will be released this week. Furthermore, employment data released last week showed the national unemployment rate remained at 3.6%; no change from the prior month and nearly the same job market strength the economy experienced before the Covid outbreak over two years ago. In sum, inflation is rising at a nearly 40-year high and the job market is nearly the strongest in history.

In the eyes of monetary policy technocrats, this isn’t an economic scenario that calls for dovishness. Instead, it gives the Fed more room to fight inflation and “vigilance” in using the blunt tool of high interest rates to slow growth to dampen the demand for goods and services (i.e. economic growth) and therefore reduce the price pressures in the economy.

All this suggests that there is more pain to come, economically and/or financially. Federal Reserve Governor Chris Waller said last month that moving rates quickly to a neutral level and into restrictive territory is necessary to slow demand and reduce inflation. He added that he foresees the unemployment rate rising to 4%-4.25%. In our view, Waller’s forecast basically suggests that the Fed is going to push the economy into recession.

For unemployment to rise from 3.6% today to more than 4%, it would most likely require a Fed-engineered recession. This is based on the Sahm Rule, which as discussed last month posits that recessions have in the past occurred whenever the 3-month moving average of the unemployment rate rises 0.5 percentage points over its minimum rate over the previous 12 months. It’s hard to envision a scenario where the unemployment rate will rise half a percentage point to more than 4% without recession, especially as the Atlanta Fed’s GDPNow model is already indicating that GDP is shrinking more than 1% during the present quarter.

Just as worrisome as the Fed driving the economy into recession are the gradually worsening financial conditions. The spread between the Moody’s Baa and Aaa-rated corporate bonds has been steadily widening since February. And, it’s trading near levels that in the past coincided with financial disruptions or widespread panic in markets.

For example, during the last 10 years, wide credit spreads correlated with the Covid-induced economic shutdown, the Fed panic of late 2018, and the European debt crises in 2012 and then 2015-2016.

What’s interesting today is that despite the steady widening in credit spreads since February, global financial markets have not been dealing with a major financial crisis. Instead, the pain is somewhat confined to weak equity and bond markets. But there seem to be a multitude of macroeconomic factors that could ignite some sort of crisis.

Interest rates have risen globally (and quickly so), which will likely choke growth. Input and living costs have risen as well, choking profit margins and consumer spending. And higher interest rates today will likely make it more difficult for the most leveraged or vulnerable consumers, corporations, and countries from easily rolling over their debts without significant haircuts to those debts and losses to their respective lenders.

While the losses in financial markets have been significant during the first half of 2022, the Federal Reserve is unlikely to back away from its tightening campaign anytime soon. As a result, we expect to see more economic and financial pain ahead. There’s most likely a Fed relief rally in the future. But we believe that something more serious will need to break in the global economy and financial markets for the Fed to change its present course.

We’ve been asked: what should the Fed do? In our view, the fact that precious metal prices, such as gold, are not sky-rocketing but are actually trading in the lower end of their range of the last two years suggests that there isn’t much monetary inflation in the system. Therefore, the higher prices that the economy is experiencing lately is being driven more by specific supply and demand dynamics -- which may be caused in part by global supply chain disruptions, historic fiscal spending, business closures of the last two years, and changes in consumer spending patterns due to the pandemic. In which case, the market for these goods and services are going through a “price discovery” that will eventually lead to more normal supply/demand balances and more stable prices. Given this classical economic point of view, the Fed should ensure that gold prices remain stable and long-term inflation expectations remain anchored, while at the same time not aggressively slow the economy and consequently create additional noise in the price discovery process. Doing so would arguably make supply/demand imbalances even more difficult to normalize and create additional economic pain to consumers and businesses.

DIAL IN FOR OUR MONTHLY

EVENT-DRIVEN CALL

Every 3rd Wednesday at 2:00pm EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Event-Driven Advisors LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B380

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Event-Driven Advisors, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Event-Driven Advisors, LLC’s disclosure document, ADV Firm Brochure is available at http://adviserinfo.sec.gov/firm/summary/291798

Copyright © 2022 Camelot Event-Driven Advisors, All rights reserved.