by Thomas Kirchner, CFA

Fed rate hikes cause currency dislocations.

Turmoil in yen and sterling are just the beginning.

Dollar appreciation is headwind for S&P earnings.

It has been quiet in the currency markets during the last few years. Now, currency crises are coming back with a vengeance.

In the last 10+ years of worldwide synchronized low interest rates, with some even running below zero, currency movements have been mostly benign. The early days of these loose monetary policies saw allegations of currency wars, an allegation first waged by Brazil's Finance Minister of the time, Guido Mantega. Smaller currencies had occasional hiccups, of which the surprise Swiss Franc revaluation of 2018 was the most notable. But generally, near-simultaneous interest rate cuts and central bank balance sheet expansions in the three major currency blocks have prevented a policy divergence that would have led to crisis-style currency movements. Now, with the U.S. going it alone in its aggressive tightening, we expect turmoil in the currency markets to return to levels of the 1980s.

Divergence

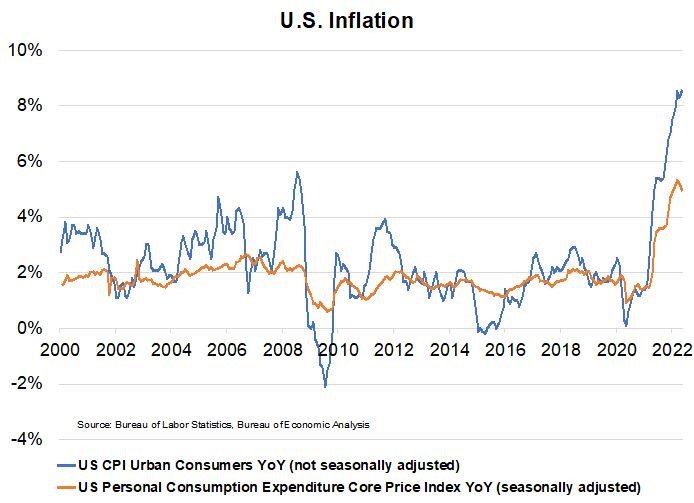

The Fed is pretty much alone in its aggressive rate hikes and is seen as the only major central bank that is not just talking about inflation, but acting. Neither the ECB nor the BoJ dare to follow its lead due to the high level of indebtedness of the public sectors in these two currency blocks. Despite a decade of ultra-low and negative interest rates (two decades in Japan), governments have not been able to balance their budgets, much less reduce debt levels. And we are not even talking about the UK, where we have no doubt that tax cuts will encourage investment and raise GDP in the long run, but in the near future, absent spending discipline, debt levels may increase. Then again, if anyone can reign in spending, it would be the Tories, the political heirs of Margaret Thatcher.

Sterling and Yen take the lead

While the pound's brief flash crash to its lowest level created headlines, many seem to have overlooked that the pound's weakness is not an isolated case. Against the Euro, at 55% of exports still the dominant trading partner of the UK, sterling is barely changed. The brief all-time low against the US dollar on September 25 that made headlines was reversed within hours. It appeared to be a technical move during Asian trading hours early on a Monday morning. The sell-off started around 2 a.m. London time. By the time traders in Europe arrived at their desks at 6 or 7 a.m. local time, the reversal was in full swing and by the end of the day, the pound had staged a 5% comeback rally from its low. By Friday, Sterling had recovered to over 1.12, returning to the pre-selloff level from the week before. When Prime Minister Liz Truss refused to undo her supply-side budget, the pound experienced another, albeit smaller, flash crash, which reversed within a few hours. [ii] Somehow, headlines focused on the low point of the exchange rate only, while volatility is the real story. 5% intraday moves in a currency typically are associated with currency crises.

Even before the pound sterling made headlines last week, the yen hit a low last seen in 1990, causing the Bank of Japan to intervene on September 22nd; its first intervention since 1998 [iii]. While the pound recovered its losses quickly on its own, the yen reacted to the intervention for only a couple of days. A brief post-intervention rally has since been completely reversed. The main difference between the pound and the yen is that Japan's monetary policy is in a dead-end with low interest rates being the only option, while the UK still has the chance to see an economic turnaround.

Pipeline of trouble

Smaller currencies are even more troubled. Here are just a few headlines over the last few days [iv]:

China State Banks Told to Stock up for Yuan Intervention

Rupee recovers from record lows

Forint Plunge to Record Tests Hungary’s Pledge to End Rate Hikes

Swiss franc's surge against the euro a boon for business

Nigeria's Forex Crisis Deepens As Gap Between Naira's Official, Black Rates Widest in Six Years

Exploring Africa's Ongoing Currency Crisis and Possible Solutions

Zloty Drops to Six-Month Low as Global Recession Fears Spread

That's just a random selection. It is clear that dollar strength is wreaking havoc on currencies. And no end is in sight.

No Plaza Accord is bad news for the S&P 500

On Wednesday, the White House ruled out a new Plaza accord to stem the rise of the dollar [v]. Dollar strength will persist for some time, and that is bad news for pretty much every currency around the world whose central bank is not raising interest rates. The only exception is probably Russia, which has lowered its interest rates to 7.5% -- down from 20% in the immediate aftermath of the Ukraine invasion -- and still saw the Ruble appreciate. But commodity currencies are a completely different story in the current environment.

It is also bad news for S&P 500 earnings. Every 10% appreciation in the dollar is a 3% headwind to S&P earnings [vi]. While the U.S. economy overall is mostly a domestic affair, that is not true for the largest companies in the country, which operate on a global scale and, in some cases, generate more revenue from exports. The dollar has risen about 17% this year on a trade weighted basis (DXY). Therefore, earnings would fall about 5% if the above rule of thumb applies [vii].

The Fed's aggressive rate hikes have at least two transmission mechanisms that can crash the economy. First, directly through higher interest rates. Second, fewer exports due to a strong dollar will slow the economy further, while at the same time, imports become cheaper, threatening market share of U.S. firms, not to mention employment effects.

Overall, the strong dollar is bad news for the stock market and the economy. After the strong moves that we have seen in currencies, we would normally be inclined to be contrarian and recommend increasing exposure to foreign equities. After all, the risk/reward ratio now favors the dollar over other currencies – we would need dollar-appreciation-forever to make a case for pulling out of non-dollar assets and reallocating to dollars. All it takes is a Fed pivot, and we would expect to see a violent dollar depreciation, given that everyone is positioned for a strong dollar. Having said that, further short-term dollar strength is to be expected. However, the question is: which foreign equities to invest in? Aside from the risk of a sudden dollar reversal, U.S. equities remain, in our view, the most appealing asset class compared to every other equity market in the world.

[I] www.worldstopexports.com/united-kingdoms-top-import-partners/

[ii] www.dailyfx.com/gbp-usd

[iii] Camelot research based on Bloomberg data.

[iv] Camelot selection of headlines from Bloomberg.

[v] Akayla Gardner: “White House’s Deese Doesn’t Expect Another Plaza Accord Coming” Bloomberg, September 27, 2022

[vi] Daniela Sirtori-Cortina, Mary Biekert: “Surging Dollar Threatens $60 Billion Hit to Corporate Revenue” Bloomberg, September 27, 2022.

[vii] Camelot calculations.

DIAL IN FOR OUR MONTHLY CALL

Every 2nd Tuesday at 11:00am EST

REGISTER FOR CALL

Thomas Kirchner, CFA, has been responsible for the day-to-day management of the Camelot Event Driven Fund (EVDIX, EVDAX) since its 2003 inception. Prior to joining Camelot he was the founder of Pennsylvania Avenue Advisers LLC and the portfolio manager of the Pennsylvania Avenue Event-Driven Fund. He is the author of 'Merger Arbitrage; How To Profit From Global Event Driven Arbitrage.' (Wiley Finance, 2nd ed 2016) and has earned the right to use the CFA designation.

Camelot Portfolios LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B405

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Portfolios, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Portfolios, LLC’s disclosure document, ADV Firm Brochure is available at www.camelotportfolios.com

Copyright © 2021 Camelot Portfolios, All rights reserved.