by Paul Hoffmeister, Chief Economist

As many clients know from our previous letters and conference calls, we have been very cautious about the overall economic and financial environments because of the interest rate shock from the Fed’s aggressive interest rate campaign. Something was likely to “break”, and the first example of that in the United States appears to have been the collapse of Silicon Valley Bank last Friday.

In short, the quick and steep rise in interest rates eroded the value of long-term bonds owned by the bank; and as depositors made withdrawals in recent weeks, the bank was forced to realize those losses and seek new capital. Unfortunately, worries about the viability of the bank appear to have triggered a run on the bank late last week, leading to its takeover by the FDIC.

The federal government has guaranteed the deposits at SVB, and the Federal Reserve initiated a new emergency program called the Bank Term Funding Program, which will allow banks to pledge bonds such as Treasuries and mortgage-backed securities so they can meet withdrawals without selling those bonds for a loss and risking further bank runs.

So where does this leave us? Has the pain completely emerged? Will this backstop for banks create a foundation for a reinvigorated market outlook?

Quite simply, we remain concerned – because the demise of Silicon Valley Bank appears to be mostly symptomatic of the interest rate hikes themselves and not yet of a major economic downturn. In other words, Silicon Valley Bank’s problems weren’t significantly related to the economy, and the economy has not yet meaningfully turned lower. Unfortunately, we believe the downturn is in its early stages and this will ultimately create pressure beyond the banks and on to consumers and corporations.

It’s particularly worrisome is that SVB’s failure is the result of interest hikes that have reduced the value of assets on the balance sheet. This is an unusual case of a bank’s collapse. In a typical bank failure, credit losses cause a capital depletion, leading to an insolvency. However, the banking system does not appear to be experiencing meaningful credit losses at this point. For some context: according to the FDIC, of the nearly $2.2 trillion in bank equity among US banks at the end of 2022, $620 billion would be wiped out if the asset losses due to interest rate hikes were recognized, leaving significantly less capital in the banking system to weather credit losses in a major economic downturn.

Because the economy is incredibly complex, economic indicators can be quite nebulous. Notwithstanding, we present in the following charts certain data that strongly suggest to us that the economy is entering a significant downturn.

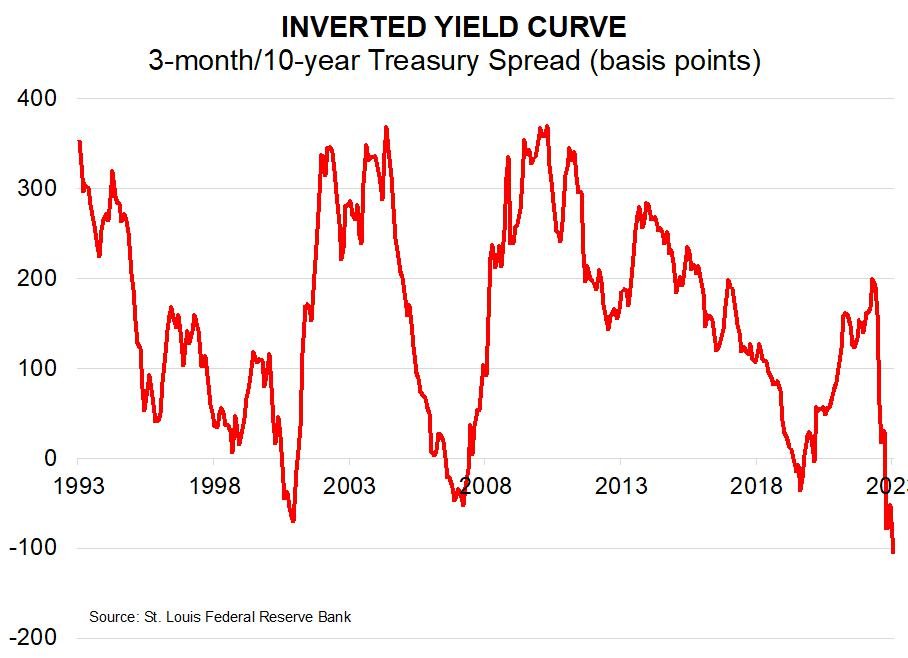

The charts, in sum, suggest that a simultaneous and severe slowdown is occurring in the western world. During the last 30 years, we’ve never seen a simultaneous yield curve inversions in the United States, Canada, UK and Germany to the degree that we see today. In our view, this a very ominous signal. As for the US economy, we also see that the manufacturing and services sectors are weakening to degrees reminiscent of 2000 and 2008; a major inventory downturn appears to be underway; home prices are weakening quickly; unemployment is about to rise; and bank lending is about to worsen.

This diverse set of data points to a significant economic recession and earnings slowdown. Therefore, our highly cautious view of the market remains unchanged.

Inverted Yield Curves in Western Economies: Ominous Signal?

Leading Economic Indicators Are Worrisome

U.S. Manufacturing and Services Sectors Are Slowing

Oil Inventories Rising: Less Demand from Economy?

Beginning of Inventory Liquidations?

Housing Market Is Slowing

Weak Shipping Costs Suggest Weak Global Economy

Beginning of Major Layoffs?

Bank Lending Likely to Decline: Less Future Demand

DIAL IN FOR OUR MONTHLY

MARKET UPDATE CALL

Every 2nd Tuesday at 11:00am EST

REGISTER FOR CALL

Paul Hoffmeister is chief economist and portfolio manager at Camelot Portfolios, managing partner of Camelot Event-Driven Advisors, and co-portfolio manager of the Camelot Event-Driven Fund (tickers: EVDIX, EVDAX).

Camelot Portfolios LLC | 1700 Woodlands Drive | Maumee, OH 43537 // B456

Disclosures:

• Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the adviser), will be profitable or equal to past performance levels.

• This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. Camelot Event Driven Advisors can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

• Any charts, graphs, or visual aids presented herein are intended to demonstrate concepts more fully discussed in the text of this brochure, and which cannot be fully explained without the assistance of a professional from Camelot Portfolios LLC. Readers should not in any way interpret these visual aids as a device with which to ascertain investment decisions or an investment approach. Only your professional adviser should interpret this information.

• Some information in this presentation is gleaned from third party sources, and while believed to be reliable, is not independently verified.

• Camelot Portfolios, LLC, is registered as an investment adviser with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply any certain degree of skill or training. Camelot Portfolios, LLC’s disclosure document, ADV Firm Brochure is available at www.camelotportfolios.com

Copyright © 2023 Camelot Portfolios, All rights reserved.